The Ultimate Guide to SME Credit Risk Assessment

Learn how to assess SME credit risk with financial ratios, bank statement analysis, and modern scoring methods. Ideal for lenders, investors, and SMEs.

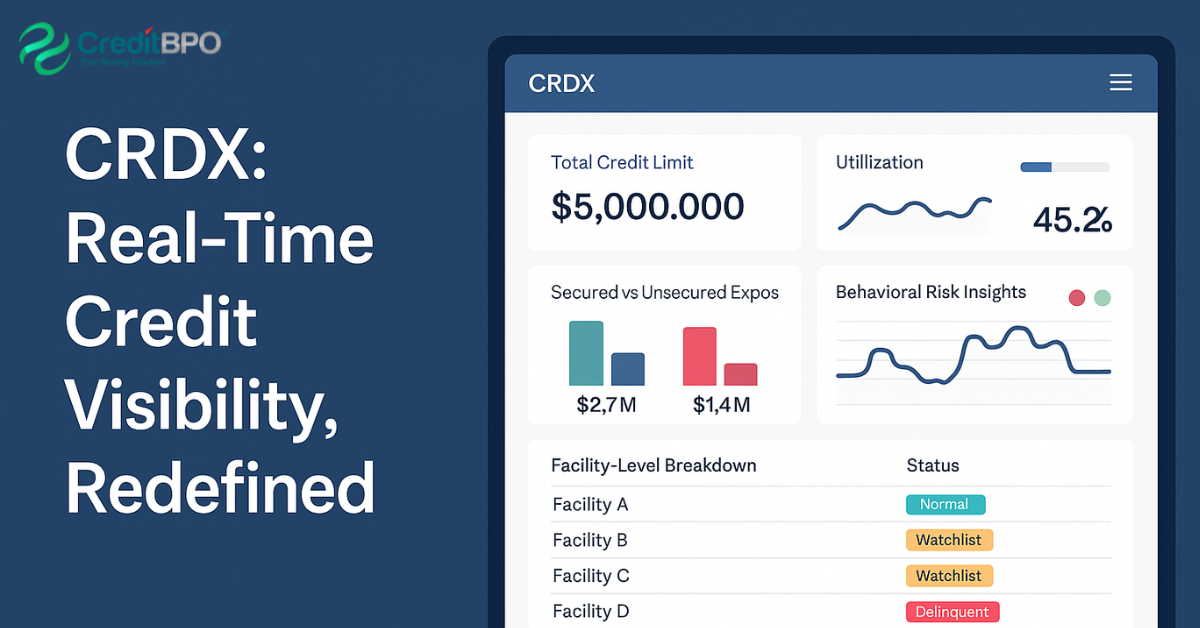

Credit Clarity, Delivered: Meet CRDX - Your Single Source of Truth for Exposure and Risk

CRDX is CreditBPO’s groundbreaking credit risk dashboard, designed to give lenders, CFOs, and procurement leaders a real-time, 360° view of financial exposure. Say goodbye to siloed data and guesswork, CRDX delivers clarity, strategic insights, and confidence in every credit decision.

Early‑Warning NPL Dashboards: Stopping Losses Before They Hit Stage 2

Discover how AI-powered NPL dashboards help Philippine banks spot loan risks 30 days early, reduce Stage 2 migrations, and save on provisioning.

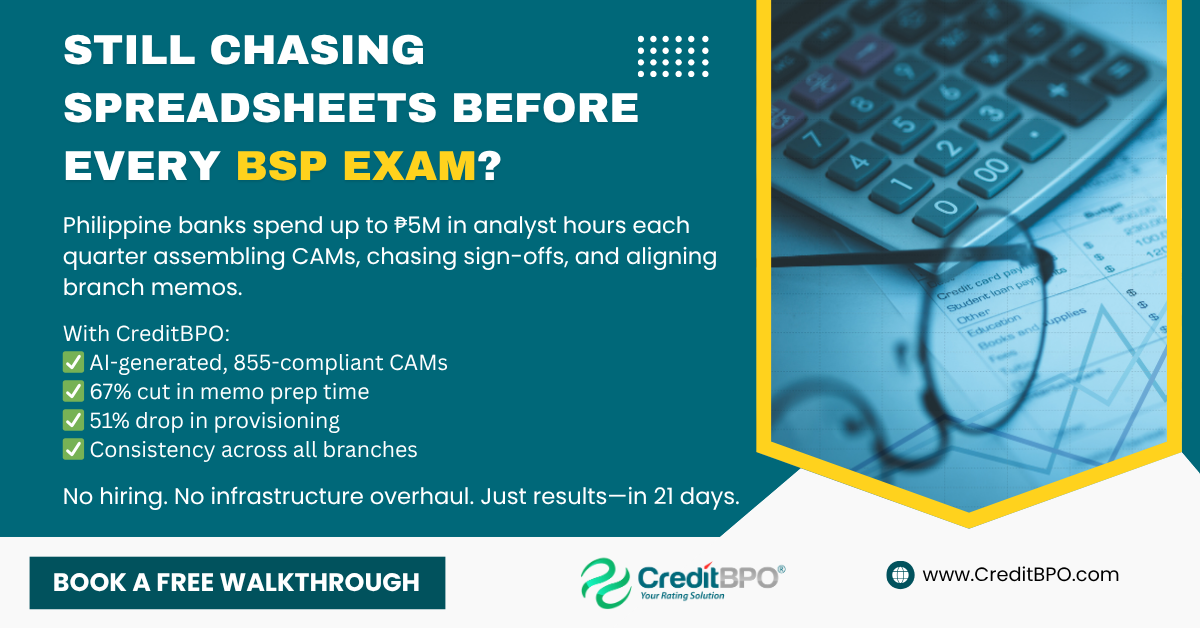

Automating BSP Circular 855 Compliance: From Paper Chase to One‑Click Evidence

Philippine banks are transforming compliance with BSP Circular 855. Learn how AI automation slashes prep time, aligns CAMs, and impresses BSP examiners in under 60 seconds.

Why Payment Controls and Good Relationships Aren’t Enough for Effective Risk Management in Procurement

Traditional procurement risk management strategies like payment controls and personal relationships can only go so far in protecting businesses from disruption. While these methods are reactive and often triggered after things go wrong, incorporating predictive insights and independent financial assessments can offer early warnings and proactive solutions. By leveraging tools like CreditBPO’s ratings, procurement teams can identify financial risks before they escalate, avoid costly delays, and strengthen relationships with suppliers."

How Predictive Analytics is Revolutionizing Procurement Risk Management in the Philippines

In today’s volatile supply chains, waiting for vendors to fail is no longer acceptable. Discover how predictive analytics and CreditBPO’s AI-powered risk scores are helping procurement leaders get ahead of vendor instability - and build more resilient supplier ecosystems.

Optimizing Vendor Relationships with Continuous Monitoring and AI

Vendor onboarding is just step one. The real risk begins after. CreditBPO’s AI-powered Standalone Financial Condition Rating Report gives procurement teams ongoing visibility into vendor health, using updated data and predictive risk models built for the Philippine market. Learn how continuous monitoring is reshaping vendor relationships and preventing disruption before it strikes.

The Power of AI in Vendor Accreditation: A Game-Changer for Every Industry

Delays in vendor accreditation cost time, revenue, and risk. Discover how AI-powered tools like CreditBPO are transforming procurement with faster, smarter, and localized vendor risk assessments - tailored for Philippine enterprises and built for operational agility.

Expanding SME Lending Portfolios in Uncertain Times: How to Maximize the Value of Audited Financial Statements and Industry Benchmarking

Expanding SME Lending Portfolios in Uncertain Times: How to Maximize the Value of Audited Financial Statements and Industry Benchmarking | CreditBPO